Running an ecommerce business comes with many challenges. Competition is fierce, and there are a variety of overhead costs you need to consider. If you’re struggling to turn a profit, you may consider adding a buy now, pay later ecommerce option for customers who need alternative financing.

More than 26% of millennials and almost 11% of Gen Z shoppers used buy now, pay later for their most recent online purchase. Buy now, pay later in ecommerce means that the buyer is financing the purchase and agreeing to pay it back in installments. This gives companies access to a wider pool of potential customers without having to lower their prices.

So, if you’re looking for a simple way to increase your website revenue and supercharge your ecommerce conversions, take a look at buy now, pay later for merchants.

Ecommerce Conversion Rate and Its Relationship to Pricing

Let’s take a closer look at conversion rates and how they relate to pricing to better understand the concept of buy now, pay later in ecommerce and how it can increase revenue.

What is an Ecommerce Conversion Rate?

Conversion rate is simply the percentage of visitors to a website that takes a desired action. Every business has a unique objective and may define conversion differently. It could refer to a sale, a visitor clicking a link, a customer adding items to a shopping cart, or a response to a form or survey.

Whatever the target goal of the campaign, conversion refers to a visitor who took the desired action. Conversion rates can be used in a variety of ways to judge the success of a business or marketing strategy.

The ecommerce conversion rate can be calculated by taking the number of conversions and dividing it by the number of total visitors, then multiplying that by 10. So, if your website had 20,000 monthly visitors and 1,000 of them converted, your conversion rate would be 5%.

5,000 conversions / 20,000 total visitors = 0.05 x 100 = 5%

What is considered a successful conversion rate will depend on the industry and the goals of the campaign. For instance, in 2021, the average conversion rate for catering and restaurants was 9.8%, whereas the real estate industry only saw a conversion rate of 2.6%. This discrepancy is due to a variety of factors, including the average cost of the goods or services being sold.

How Do High Prices Affect this Rate?

Conversion rate is tied to a variety of different factors, such as the quality of your products, the design of your website, and the success of your content strategy. But one of the biggest barriers to a solid conversion rate is high prices.

Most of us don’t think twice about making a $15 purchase, but a $1,500 purchase requires more scrutiny. The more you charge for your products, the more likely the customer is to overthink and abandon the purchase.

Another major drain on conversion rates is hidden costs. Approximately 50% of users who abandon their carts before completing a purchase do so because of hidden costs, such as shipping, service fees, etc. Most customers today will expect a few added costs. But beyond a certain threshold, they may abandon the purchase altogether.

Some may walk away because they find the prices unreasonable. Yet others may still want to make the purchase but don’t have the cash on hand to complete the transaction. A lack of financing options is, therefore, another major drain on conversion rates.

Many customers may feel more comfortable with paying off the purchase over time but become intimidated by larger costs upfront. So, buy now, pay later is a great way to accommodate those ecommerce customers who would otherwise convert.

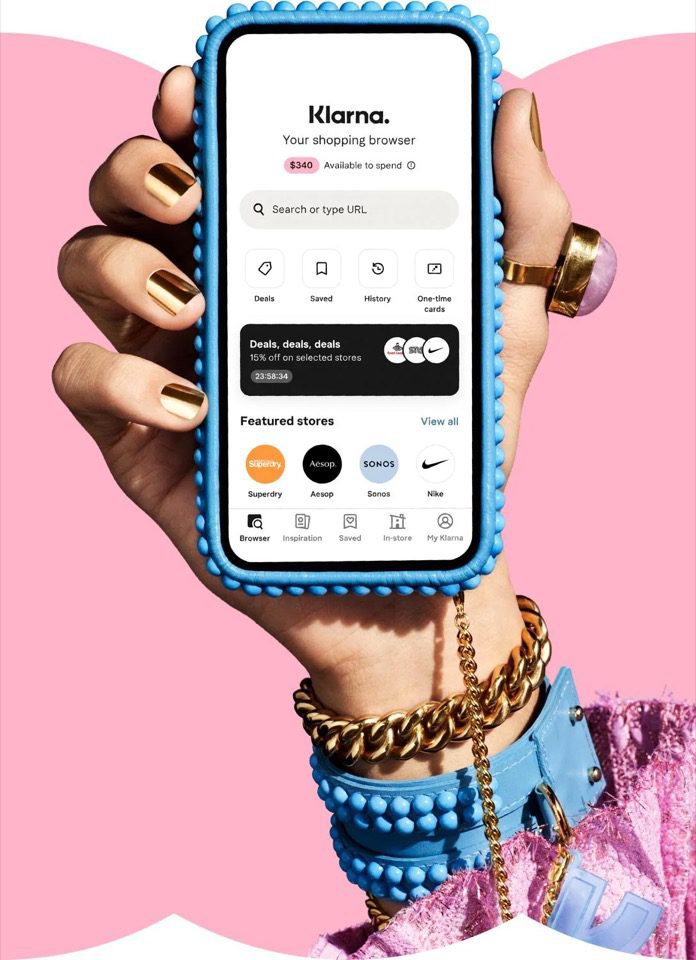

Source: Klarna

The Solution: Buy Now, Pay Later

Definition: Buy now, pay later in ecommerce refers to the short-term financing of an online purchase. A third party finances the purchase, allowing the customer to pay it back in installments or at a later date. Payments may be due either monthly, quarterly, or yearly, and there will be a set amount of time during which the entire amount must be paid.

Utilizing buy now, pay later for ecommerce purchases has a variety of benefits for customers. It allows consumers to receive the product or service before completing the full payment as if they had purchased it in one go. Plus, there is typically no interest charged on the financing, and it doesn’t affect your credit score, as long as installments are made on time.

How it Works:

Buy now, pay later for ecommerce is actually much simpler than it sounds. It just requires an additional step at checkout to complete the transaction. Here are the basic steps:

- Customers select buy now, pay later on the ecommerce website payment gateway, which will redirect them to the payment provider’s website

- Next, they will be able to create an account and login

- Once their account is set up, they can choose the frequency and duration of the payment installment (twice per month, four times per year, etc.)

- Once the purchase is complete, the business receives all the funds (minus any fees or taxes)

- Customers will typically have to make the first payment upfront to receive the product or service

- As long as the customer continues to make payments on time, no added fees or interest will be charged

So, buy now, pay later for merchants is a simple way to offer your customers more purchasing options, which can lead to more sales and conversions.

Ecommerce Benefits of Buy Now, Pay Later

Buy now, pay later offers a variety of essential benefits for both the business and the customer. Here are some of the major advantages.

For Customers:

- No Need for Credit Cards: Buy now, pay later in ecommerce offers all the benefits of paying with a credit card, without some of the disadvantages, including high-interest rates. According to a survey conducted by e-marketer.com, one of the main reasons that customers use the buy now, pay later option is to avoid paying credit card interest. Before it was introduced, credit cards were one of the few ways the average consumer could finance large purchases. But they often feature exorbitant interest rates. With BNPL, customers can split up the payments without worrying about creating additional debt.

- Affordable, preferred payment option: Buy now, pay later makes buying items online easier and more affordable. So, many who use the service make it their preferred payment option when shopping online. About 45% of all buy now, pay later users said that they use the service frequently (at least once per month) and 47% claim that they use it “most of the time” when shopping.

- Convenient and Flexible: Another major benefit of buy now, pay later for ecommerce is flexibility and convenience. Customers don’t have to give out detailed financial information; they can just input some basic data and get started with a few clicks. Payment processing can be very complex, especially for small online businesses. Buy now, pay later options make the process simpler and more streamlined, so customers don’t get frustrated or discouraged while trying to purchase an item. Over one-third of US consumers have used a BNPL service, including over 20% of consumers in each listed age group. It’s not just the tech-savvy younger generation using the service; it’s simple enough for all demographics to understand.

For Businesses

- Increase Sales: There are numerous benefits of buy now, pay later for merchants as well, including increased sales. BNPL is expected to facilitate $680 billion worth of transactions globally in 2025. Offering alternative ecommerce payment options like buy now, pay later is a simple way to increase revenue and tap into an underserved market that is interested in your business but otherwise couldn’t afford your products or service.

- Less Cart Abandonment: Cart abandonment is another major drain on conversion rates. Approximately 81% of all shoppers abandon their carts before completing a purchase. Buy now, pay later for merchants can help reduce cart abandonment because a significant percentage of those shoppers leave due to high prices or a lack of payment options.

- Grow Your Average Order Value (AOV): Another major benefit of buy now, pay later for merchants is that it can help grow your average order value. Around 55% of consumers say they spent more using buy now, pay later than they normally would using other payment methods. Buy now, pay later makes large ecommerce purchases less intimidating for the average consumer, which can lead to larger orders and more purchases.

- Attract New Customers: Buy now, pay later helps ecommerce businesses attract new customers who wouldn’t otherwise be able to afford your products, especially if you’re selling high-ticket items. Many customers already have an account with some of the major providers, so all they have to do is input their login information to get started. This can help attract a whole group of shoppers to your business that is already using buy now, pay later for ecommerce.

- Build More Trust: Having support from an established payment servicer is another major benefit of buy now, pay later for merchants that can help establish consumer trust. If you are a new business or unknown to the customer, they may not feel comfortable inputting their credit card information directly into your ecommerce site. Offering multiple payment options from established servicers and financial companies can be a good way to convince customers that your business is legitimate and their data is safe.

- Engage Younger Consumers: About 15% of millennials and 5.7% of Gen-Z used BNPL in-store, compared to only 3% of older generations. Buy now, pay later for merchants is quickly gaining steam and becoming a preferred payment option among younger shoppers. If you want to boost your popularity among younger generations, you should consider including the option.

- Boost Customer Lifetime Value: Customer lifetime value is the amount of revenue a company expects to earn from the average customer over the entire course of their business relationship. Customer retention is important because it costs about 5x more to acquire a new customer than it does to retain an existing one. Buy now, pay later for ecommerce helps boost customer lifetime value by allowing customers to interact with your business for a longer period. Plus, it helps build brand loyalty and trust, which can result in more repeat sales.

Types of Buy Now, Pay Later Providers

There are many different buy now, pay later options for merchants to choose from. Here are a few of the major types and how they work.

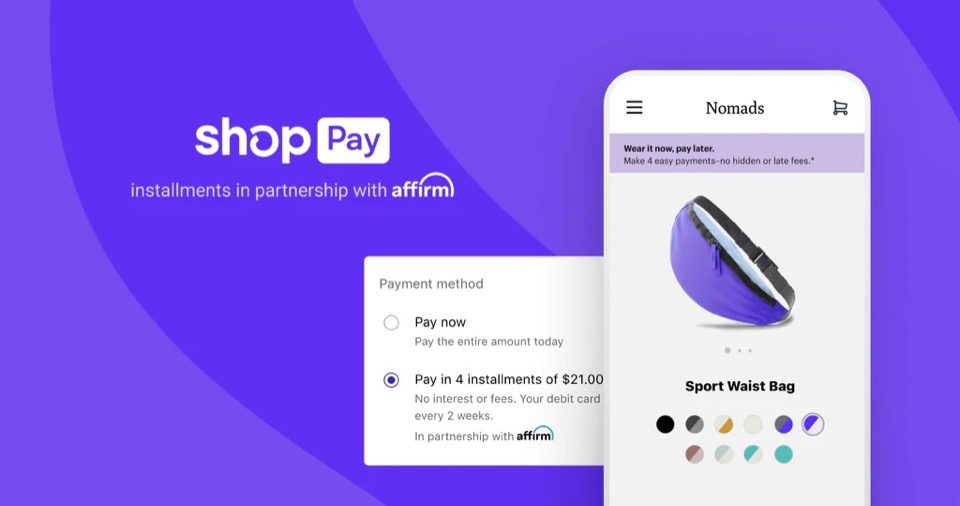

Source: Shopify

- Direct Providers: Direct providers are those that offer financing directly to the consumer. They are available at the point of sale and help broker the transaction between the business and the customer, so the process is smooth and easy. Examples include Klarna and Affirm.

- Facilitators: Facilitators are ecommerce platforms and payment processors looking to get in on the buy now, pay later ecommerce trend. They use their existing relationships with online sellers to facilitate partnerships with direct providers and make integration even easier. Examples include Shopify and Stripe.

- Retroactive Providers: Retroactive providers are the financial services industry’s response to buy now, pay later for ecommerce. They offer special financing options for customers who make purchases on their credit cards. Chase and American Express have both offered this option to compete with the growing BNPL industry.

So, if you own a small business and want to implement a buy now, pay later option on your own ecommerce site, you’re in luck. There are plenty of products available to help you get started.

Take Your Conversions to the Next Level

If you feel overwhelmed by the technical aspects of adding a BNPL option to your website, you might consider hiring a professional to get the job done. Read more about outsourcing your web development on the BESTWEB blog to help you make up your mind.